The Evolution of Instant Financial Services

The financial services industry has undergone a remarkable transformation over the past decade, driven by technological advancement and changing consumer expectations. Traditional banking models, once characterized by lengthy processing times and rigid operational hours, have given way to innovative platforms that prioritize speed, convenience, and accessibility.

This evolution has been particularly pronounced in the realm of cash access and money transfer services. Where once consumers had to visit physical locations, wait in lines, and navigate complex paperwork, today's solutions offer streamlined digital experiences that can be completed in minutes rather than hours or days. The integration of artificial intelligence, machine learning, and blockchain technologies has further enhanced these services, providing more accurate risk assessment, faster transaction processing, and improved fraud detection capabilities.

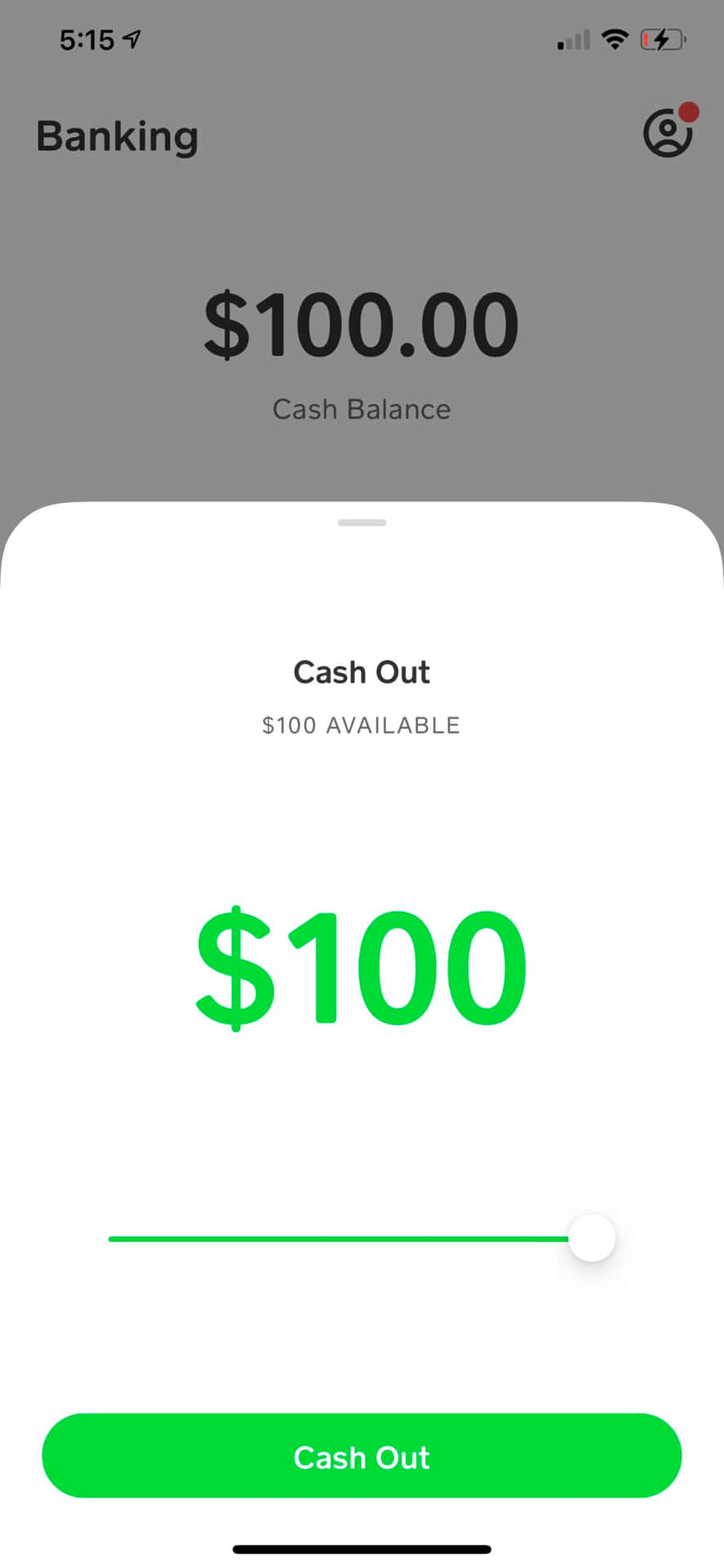

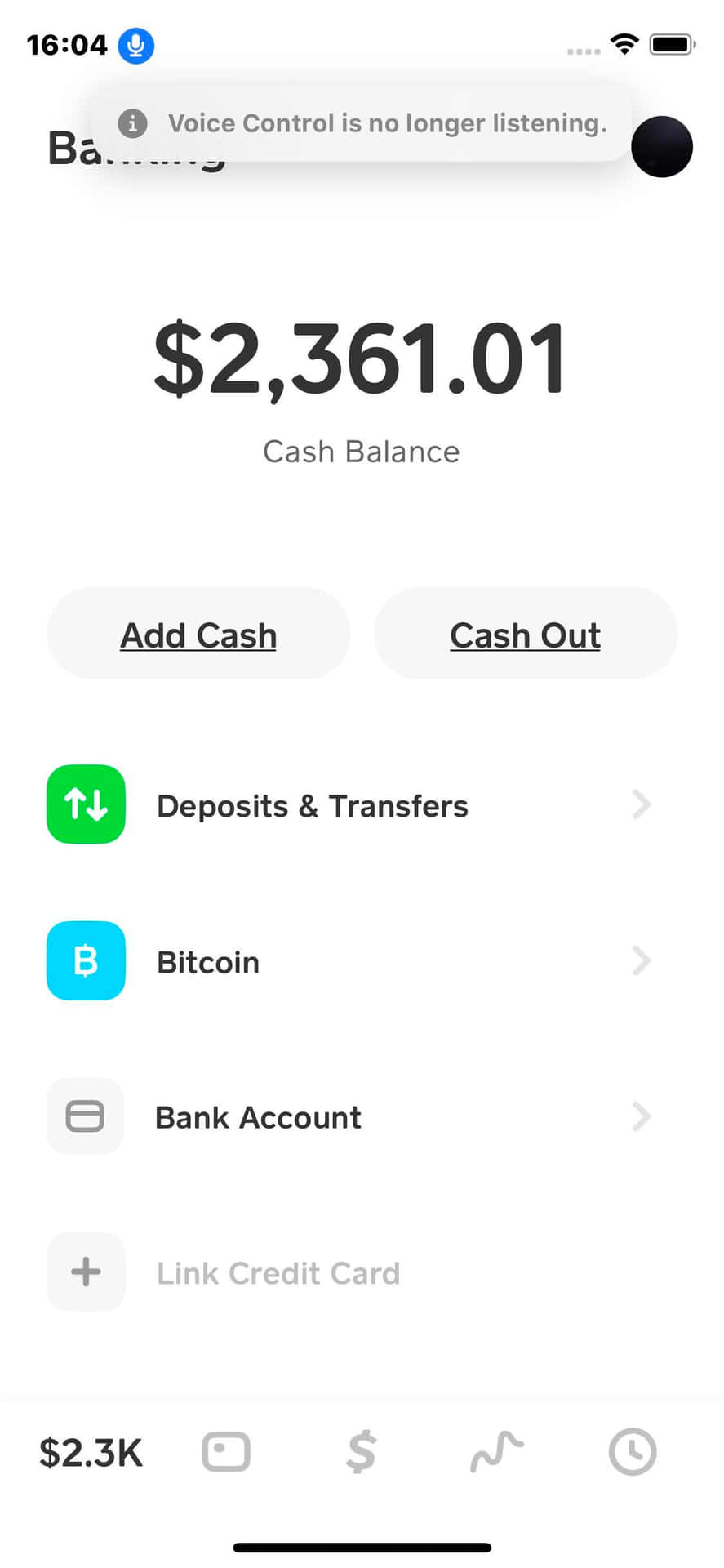

Mobile-first design principles have also played a crucial role in this transformation. Recognizing that consumers increasingly rely on smartphones for their daily activities, modern financial platforms have been optimized for mobile use, ensuring that critical financial services are always within reach. This mobile optimization extends beyond simple responsive design to include features like biometric authentication, push notifications for transaction updates, and intuitive user interfaces that make complex financial operations accessible to users of all technical skill levels.

.png?auto=format,compress)